Machine Learning (ML) is a subset of AI that enables units and techniques to study from data utilizing algorithms and improve with out express programming. In this text, we’ll discover 5 outstanding fintech developments set to form the trade within the coming months. According to Statista, there will be eight.4 billion more voice assistants than people on the planet by 2025. By integrating them into monetary management and consumer preferences, fintech companies hope to extend the usage of digital assistants.

Banks open new income streams, and prospects get greater entry to monetary providers precisely when they need them. The Open Network for Digital Commerce (ONDC) is ready to transform the fintech sector, offering avenues for startups specializing in lending know-how. Concurrently, the enlargement of UPI into credit functionalities may revolutionize lending practices, doubtlessly leading to trade consolidation and optimization. The ONDC allows startups to access a broader customer base, streamline operations, and innovate lending products. Likewise, UPI’s integration with credit score companies facilitates seamless mortgage disbursements, prompting adjustments such as market consolidation and heightened innovation in lending know-how startups. ML models look at varied elements to determine potential fraudsters, resulting in a big 20% discount within the workload required for investigations.

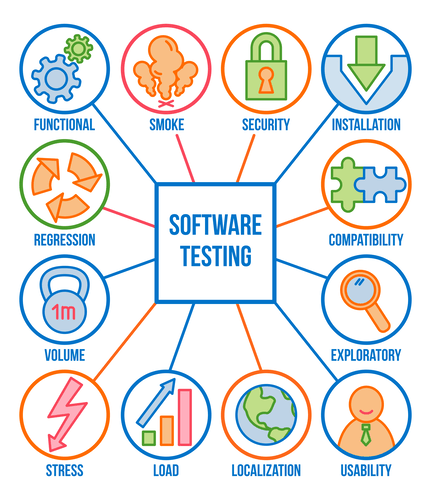

Function Of Ai In Cybersecurity

This contains monitoring account exercise, flagging suspicious transactions, and implementing real-time fraud detection systems. As extra merchants undertake cashless fee methods, consumers will have the power to observe their spending in real-time, giving them more management over their funds. Furthermore, companies will benefit from quicker transactions, lower transaction prices and decreased threat of fraud. However, in order to efficiently implement these fintech trends, startups must allocate their resources cost-efficiently.

As interest rates stabilize, debtors are likely to return to the market for loans. Personal loans and buy-now-pay-later loans will probably show the most speedy rebound. On the back of anticipated rules in 2023, there shall be much more readability for the pay-later class which has seen its share of scrutiny.

Fintech Solutions With Tribalscale

It enables monetary service suppliers to make quicker and extra informed decisions by analyzing giant volumes of information, leading to the creation of innovative monetary instruments and services. Open banking, which extends beyond conventional banking companies into varied sectors, is a key facet of this transformation. Businesses of all sizes can benefit from open banking by sharing buyer information with authorized third-party suppliers, gaining useful insights into buyer behavior.

Blockchain technology is usually known as a “distributed database” or “electronic ledger.” Each transaction is documented in a singular block related to the network’s earlier blocks. According to the timetable, they ship the required paperwork to regulatory institutions. Financial establishment operations are ruled by laws, commonplace practices, and rules that one must pay consideration to and cling to. Businesses should maintain accounting data, tax stories, income reviews, and buyer reports. Given the extent of uncertainty in the market in 2023, it was no surprise to see fintech funding back off considerably from the levels seen over the last two years. While H1’24 is likely to begin off in a very subdued style, any downward movement in interest rates might spur some renewal of deals activity.

Digital banks are top-rated among millennials and Gen Z shoppers, who are usually extra comfortable with digital services, and worth the convenience and accessibility that neobanks present. McKinsey’s analysis indicates that these youthful demographics are extra top fintech trends likely to switch to digital banks due to their desire for online interactions and quick efficient service. One of the important purposes of data analytics in finance is credit score threat analysis.

The integration of DeFi and DLT will considerably influence international financial markets as they offer a more decentralized, clear, and optimized system. Continuous developments in know-how, regulation, and interoperability are essentialAnd, all it will assist to fully understand DeFi and DLT’s potential. As the DeFi ecosystem grows, so does the necessity for interoperability amongst completely different blockchains and DLT platforms.

It stimulates fintech firms to maintain up with the occasions and actively undertake the newest rising technologies, to provide the anticipated degree of providers and keep a high satisfaction fee. FinTech Magazine connects the leading FinTech, Finserv, and Banking executives of the world’s largest and quickest growing brands. Our platform serves as a digital hub for connecting industry leaders, covering a variety of providers including media and promoting, occasions, analysis stories, demand generation, information, and knowledge services.

Users are slowly starting to grasp some nice advantages of working with open data since information interchange promotes scholarly investigation, software program advancement, and enhancement of financial services. One of essentially the most ubiquitous fintech developments right now driving sustainability is contactless payments. The innovation has eradicated the necessity for cash or paper tickets on public transportation providers, lowering paper utilization and eliminating the necessity for money by making card funds less complicated to complete.

Monetary Inclusion Initiatives

More than 30% of monetary institutions spend larger than 5% of their income on compliance. Juniper Research predicts the regtech trade will expertise 200% development via 2026. This kind of expertise can provide improved efficiency, larger accuracy, and higher insights for the complete company. Consumers are looking forward to AI serving to them cut invoice spending, negotiate lower rates, and supply budgeting recommendation. Fintech corporations search for ways to leverage AI to provide faster service and expand their offerings. New strategies of figuring out credit score use different data to credit score scores—such as money circulate information, pay stubs, and utility bills—to paint a extra complete image of a borrower’s funds.

Looking ahead, it’s anticipated that we’ll see additional adjustments in the method of living and interactions between individuals. Sustainability is perhaps the most important consideration for enterprises, organisations and companies of all sizes in 2024. The need to scale sustainable practices is extra necessary than ever, and the fintech trade is no exception.

Current Biggest Developments In Fintech

In 2024, 17% of all phishing assaults were aimed toward finance and fee services. DailyPay is the earned wage access supplier for 80% of the Fortune 200 companies that utilize this sort of know-how. In reality, workers with earned wage access are doubtless to stick with their employer. One firm reports that their on-demand pay solution decreases turnover by as a lot as 73%. As for the front office, Accenture stories that banks can see a 2 to 5x improve within the number of customer interactions and transactions through the use of AI.

The Commons app invitations consumers to help in “driving the shift to a low-carbon economy”. In an example of their work, one of many brand’s finance and accounting prospects automated 22 processes and saved 80k hours of guide labor as a result. Many monetary institutions are turning to robotic process automation (RPA) in an effort to drive down costs and make their groups more environment friendly. In previous years, these banks had been manually mapping their regulatory obligations by way of a process that took roughly 1,800 hours of human effort. Australian banks ING and CommBank give us one instance of how regtech can dramatically impression compliance efforts.

Advances In Synthetic Intelligence And Machine Learning

This is why stablecoins are actually gaining traction as one of the world developments for fintech. While the idea of embedded finance is nothing new, it might simply be the subsequent revolution in payments. A research by PwC highlights how RegTech can be instrumental in credit score danger modeling, market risk evaluation, and operational danger administration, by providing a more nuanced approach to identifying and mitigating risks. Personalization via information analytics is changing into a central theme within the monetary trade.

- Over the years, advances in fintech have made an incredible influence on how financial transactions are executed as well as the finest way we view cash.

- Open banking strategies are being actively implemented in different areas outside the EU.

- This pattern is ready to proceed within the years ahead, with monetary service suppliers more and more relying on big knowledge and open banking to stay competitive.

- As the use of cryptocurrency continues to rise, so does decentralization of finance and banking as an entire.

- According to a report from Deloitte, DeFi has the potential to create more open, inclusive, and fair financial markets which would possibly be accessible to anybody with an web connection.

- With their cell banking app, Chime makes access to money for any direct deposits set as a lot as your checking account two days earlier.

For occasion, the Bank of America Corporation beforehand needed to pay $42 million to New York State for providing clients solely a cursory clarification of how their share orders had been dealt with. The California Department of Financial Protection and Innovation took Chime to court docket because they believed the corporate was erroneously calling itself a financial institution. Insider Intelligence predicts practically 20% of the US population may have an account at a neobank by 2025. Behavioral biometrics platforms analyze human exercise to detect fraud and identification theft.

International Insights

Digital wallets, digital property, distributed information storage and trade, zero-knowledge identification proof, and good contracts are just some of the technologies that support this newest fintech pattern. Digital asset exchanges produced $15B in income in 2021, and DLT seems set to thrive in 2024. Imbuing various gamification methods helps a fintech app stand out from the group, acquire word-of-mouth advocacy, and succeed.

With our complete strategy, we strive to supply timely and priceless insights into greatest practices, fostering innovation and collaboration within the FinTech community. Over the previous few years, cellular fee solutions for carbon offsetting have grown in recognition. These services allow users to offset carbon emissions resulting from monetary transactions by supporting renewable power initiatives or reforestation efforts.

Her 15-year business and finance journalism stint has led her to report, write, edit and lead teams overlaying public investing, non-public investing and personal investing each in India and overseas. She has beforehand labored at CNBC-TV18, Thomson Reuters, The Economic Times and Entrepreneur. It’s predicted that AI will take over a few of the duties traditionally handled by human monetary advisers, permitting for higher effectivity, pace and accuracy in managing funds.